Weekly INFO Session | Progress | Voices of Reason | Rex Tillerson | Jerry Taylor | Bob Inglis | James Hansen | Elon Musk | REMI report

Weekly INFO Session | Progress | Voices of Reason | Rex Tillerson | Jerry Taylor | Bob Inglis | James Hansen | Elon Musk | REMI report

|

Pictured: Over 1,500 Citizens Climate Lobby volunteers who regularly descend on Capitol Hill – at their own expense – and visit almost every member of Congress (500+ meetings) annually, urging our lawmakers to act on climate by enacting a bold climate policy that's effective, good for people and the economy. Throughout the year, dedicated CCLers have multiple lobby meetings with their Represetatives, now via Zoom. Pricing carbon is a consensus policy solution among thousands of top economists and leading scientists, and recently an emerging group of very prominent business groups too, including Business Roundtable, U.S. Chamber of Commerce, Electric Power Supply Association, U.S. Commodity Futures Trading Commission. |

"Don't tell me it's impossible. Tell me you can't do it." - Dean Kamen

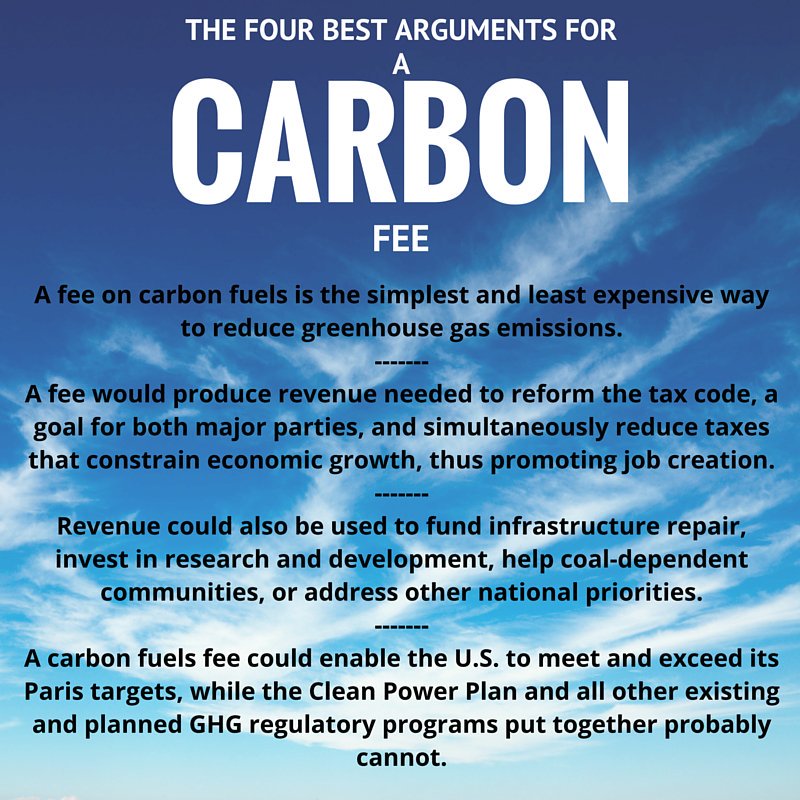

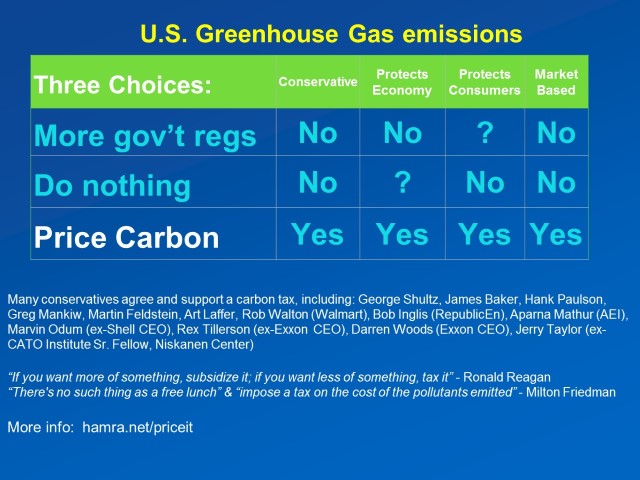

The consensus is in. Experts, economists from across the political spectrum, agree:

The answer: a revenue-neutral a cash-back carbon tax; the carbon fee & dividend - like the Energy Innovation and Carbon Dividend Act. / How this works in 2-minutes.

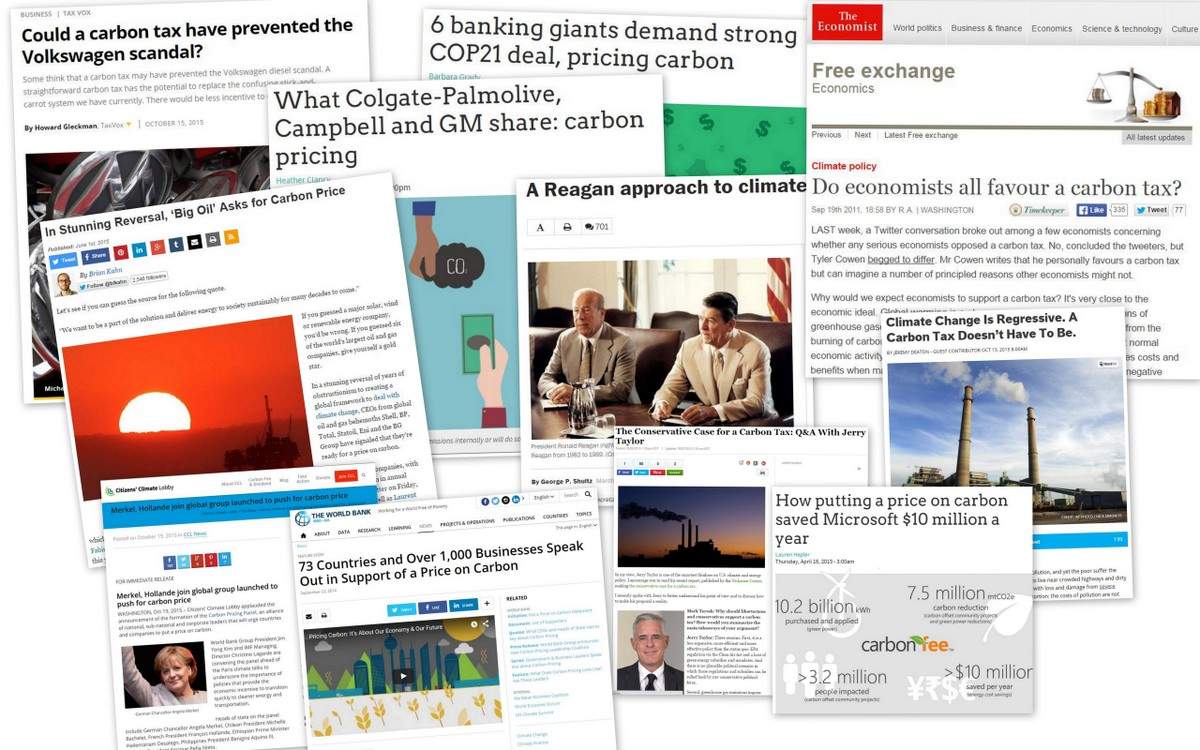

The call to put an honest price on carbon is coming from all directions:

Learn about the conservative-friendly Carbon Dividends plan now.

The World Bank Carbon Pricing Dashboard

WHERE in the world is carbon pricing happening?

Why Swarthmore College Endorses a Carbon Price (CCL's Higher Education Action Team)

100 state & local governments pass resolutions for CF&D - Citizens' Climate Lobby

5 conservatives arguing for a price on carbon.

Download

a list of leaders who endorse bold climate action and pricing carbon, including

national security leaders, energy companies, business associations, conservative

thought leaders, newspapers, municipalities and healthcare leaders.

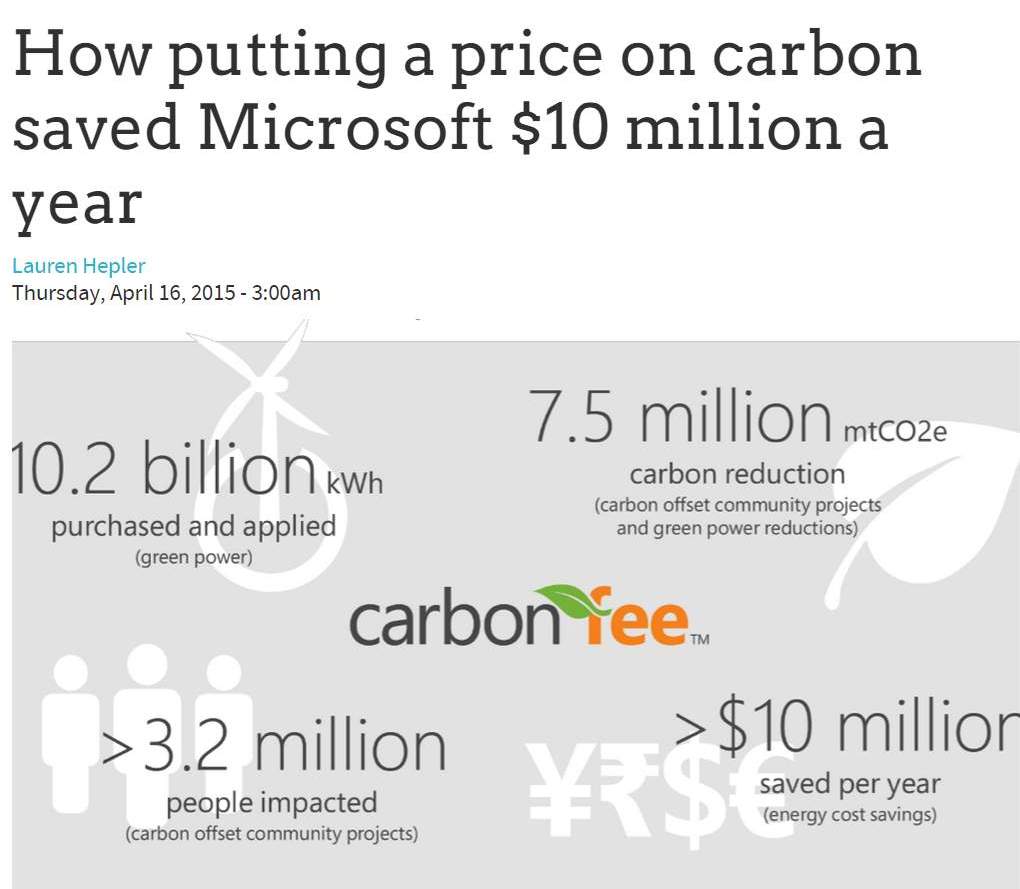

| A revenue-neutral price on carbon emissions is considered

the Holy Grail of climate action by most thought leaders,

including many leading companies. |

Click

here to view a list of Nations, States, Cities, Businesses and Investors

who support carbon pricing. (PDF document) |

http://lowcarbonusa.org |

"Seventy-four countries, 23 subnational jurisdictions, and more than 1,000 companies and investors expressed support for a price on carbon ahead of the UN Secretary-General’s Climate Summit." |

-------------------

Robert Rubin (Co-Chairman; Council on Foreign Relations, Former Secretary of the U.S. Treasury) says: "Climate change is the greatest threat facing humanity today. To avoid catastrophe, we must dramatically reduce the carbon intensity of our modern energy systems, which have set us on a collision course with our planetary boundaries." (Also endorses pricing carbon)

More statements from conservatives

Niskanen Center's compilation of endorsements.

ExxonMobil CEO Rex Tillerson's endorsement

Carbon

tax: A cheap, proven fix to climate change

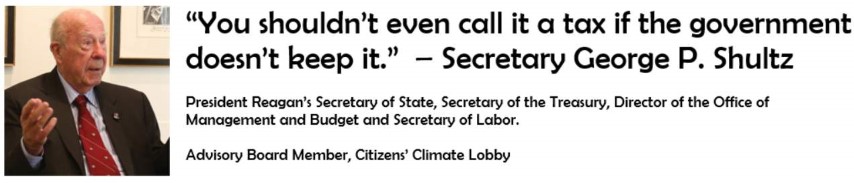

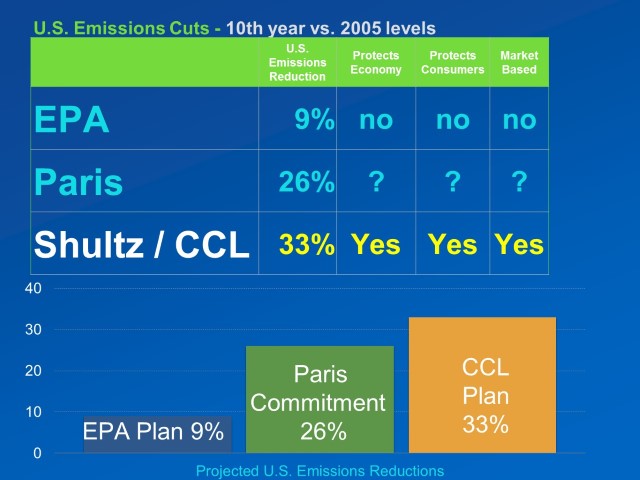

The Fee and Dividend plan is considered by many thought-leaders on both sides of the political aisle as the most effective solution to reducing greenhouse gasses. A fee + dividend plan is consistent with conservative economic principles. F&D has the endorsement of leading economists, top scientists, and leading economic policy analysts, including Republican icon, Secretary George Shultz, President Reagan's Treasury Secretary, Secretary of Labor, and Secretary of State. The Shultz-Becker Carbon Tax proposal is explained in this WSJ article.

Robert Reich explains Fee and Dividend

in 2½ minutes.

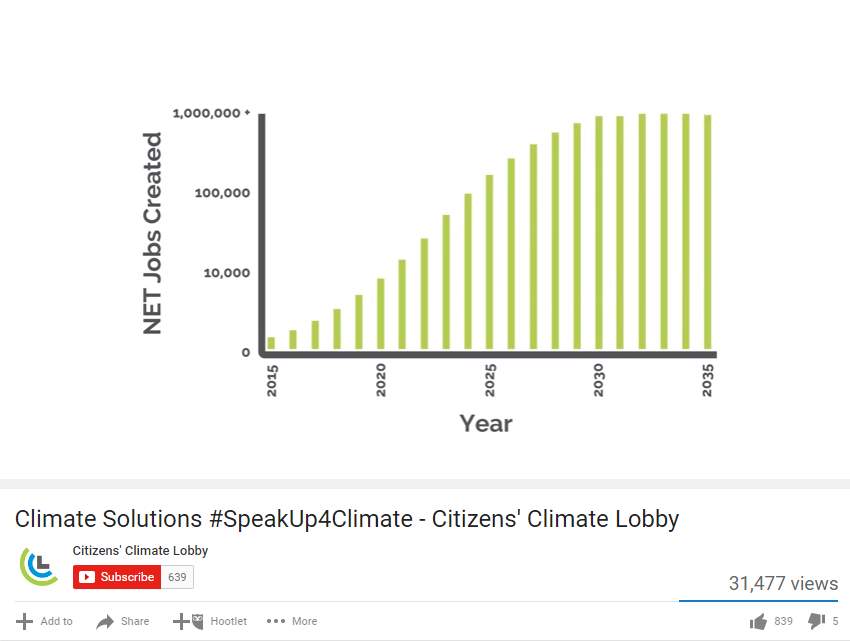

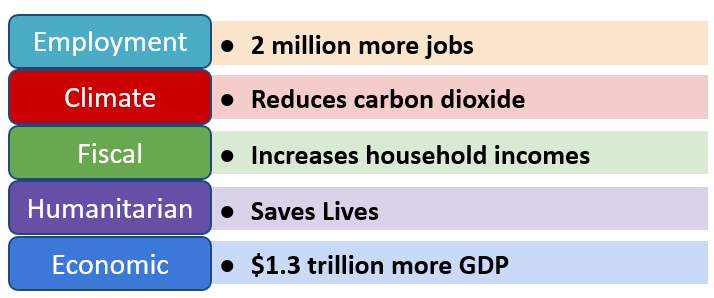

REMI

Report's General Findings (PDF).

Regional Economic Models, Inc. is a leading economic modeling company

with sector clients including energy, universities, municipalities and more.

We have three choices:

The libertarian argument for a carbon tax https://t.co/WmbGp2YuUO

— Elon Musk (@elonmusk) July 29, 2016

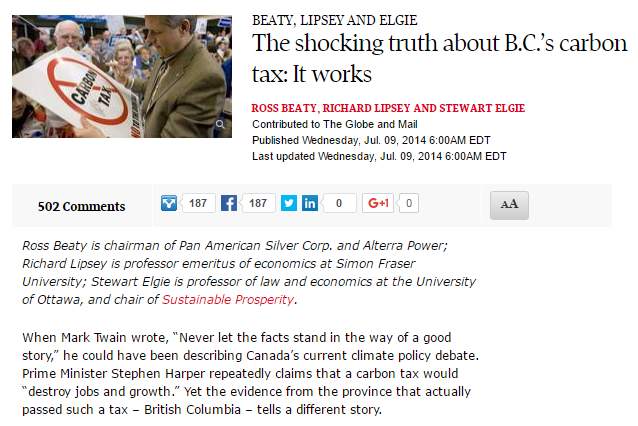

British Columbia has been doing this since 2008 with GREAT

success.

The revenue-neutral carbon tax could be a workable policy framework

for countries around the world – and be the policy most likely to preserve

the ability of every sector of society to seek new efficiencies and technologies.

The province of British Columbia in Canada has instituted a carbon tax that

offers policymakers a model of what such a system might entail."

Former Congressman Bob Inglis, founder

of:

Bob Inglis visits Miami for screening of "Merchants of Doubt" with

John Englander, Coral Gables Jim Cason, and Miami republicEn.org

group.

More than 430 companies around the world have already set internal prices for their carbon emissions. In 2014, the number of companies setting an internal price for carbon stood at just 150. Another 583 companies say they will adopt carbon pricing in the next two years.

74 countries, 23 sub-national jurisdictions, and more than 1,000 companies and investors expressed support for a price on carbon in advance of COP21.

Even BIG OIL is on board. In

Stunning Reversal, "Big Oil" Asks for Carbon Price (PDF)

Exxon Mobil endorses a revenue-neutral carbon

tax. ExxonMobil: "Our analysis shows that a revenue-neutral

carbon tax would be the most effective approach." from ExxonMobil,

Paris, and carbon policy | ExxonMobil's Perspectives Blog

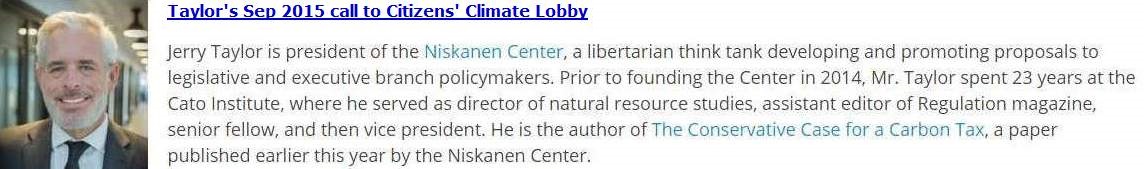

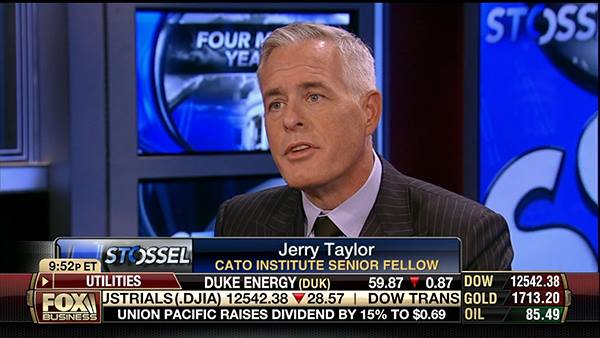

Taylor was a Sr. Fellow at CATO Institute.

After 23 years, Taylor left the CATO Institute amid excessive Koch Brothers

influence and formed the Niskanen Center, a libertarian think-tank focusing

a few very important areas, including climate change. "The

Conservative Case for a Carbon Tax" (PDF) is a provocative piece of

thought-leadership re: the most popularly held, market-based alternative to

expensive and ineffective regulations. (Most

thought-leaders agree.)